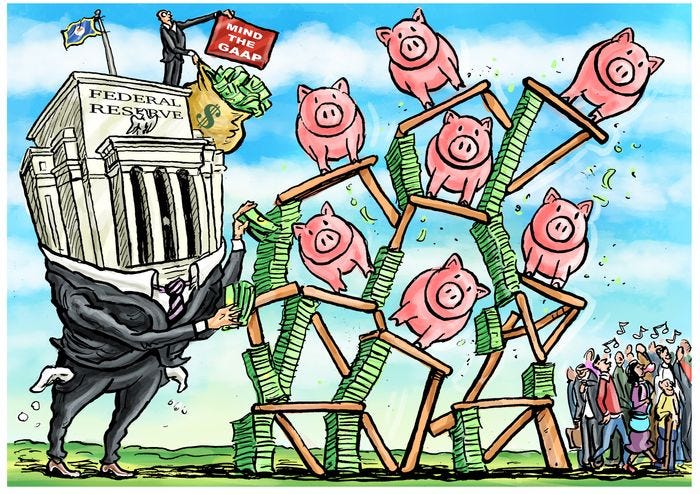

As a mostly classic libertarian, I think financial sovereignty is a must, which has only become increasingly important. We live in a world where cash is digital and the banks as well as government are in full control. This can become an issue, which is why I think holding some money in more private options like cryptocurrency in your own wallet or physical gold/silver is a MUST. Especially now that we are in the final stages of unbacked paper money where cheap debt and money printing are the norm. And if things go wrong, we could even see a new strategy unfold, known as bank bail-ins which is some of the most horrifying stuff I have ever come across.

- Bank Bail Ins VS Bank Bail Outs -

Now to understand why this stuff is terrifying we need to know what bail-ins and bailouts are. Let’s start with a bailout because this is what we saw in 2008 when the banks went bankrupt due to bad real estate investments.

Quote: The term “bailout” is typically applied to a situation in which resources are provided — often in the form of cash or a loan — to a struggling entity to save it from collapse. The recipient can be a bank, a corporation, or another type of organization.

The overall purpose of a government deciding to bail out a bank or other business can be to help protect the national economy, which may otherwise suffer dire consequences due to factors like job losses or lack of investor confidence."

Overall people aren't fans of bank or company bailouts, because they see it as unfair that these rich entities just get money when things go wrong. This is understandable, but in the end, many people get aid and bailouts in today’s economy, from welfare to stimulus checks. But still, they didn’t get this money because they took massive business risks, so, in many ways, critics have a good point. However without bailouts, the effects could be a lot worse, it could turn a recession into a complete depression that will result in absolute hell. So a bailout like the one that was seen in 2008 was needed and is in the interest of the common folk.

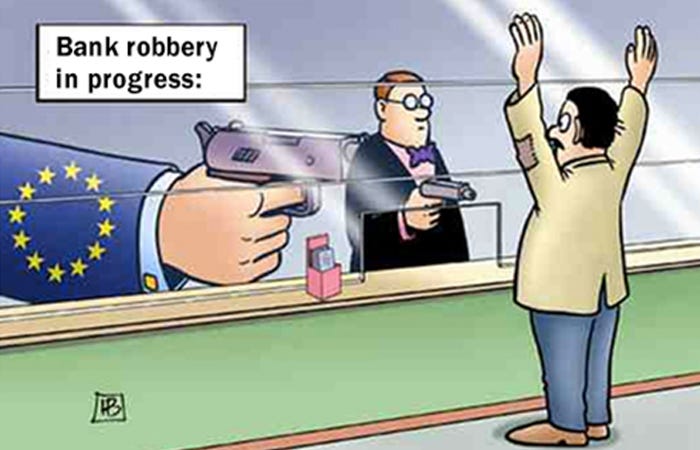

But what is bail-in then? Well in my opinion a more evil and oppressive solution for the same problem.

Quote: "A bail-in provides relief to a financial institution on the brink of failure by requiring the cancellation of debts owed to creditors and depositors. A bail-in is the opposite of a bailout, which involves the rescue of a financial institution by external parties, typically governments, using taxpayers’ money for funding. Bailouts help to prevent creditors from taking on losses, while bail-ins mandate creditors to take losses."

Now this might seem fairer until you find out that these “creditors” and “depositors” are us, they are talking about the money in our bank accounts. So in the end people who have saved any money will be forced to take a massive haircut, usually getting worthless shares of the company or bank in return. We saw this in Cyprus in 2013, here uninsured depositors (defined in the European Union as people with deposits larger than 100,000 euros) in the Bank of Cyprus lost a substantial portion of their deposits. In return, they received bank stock. However, the value of these stocks did not equate to most depositors’ losses. I would call this even more unfair, in the end, everyone should take a small hit, instead of some “rich folks” who trusted a bank, losing a fortune. Because usually regardless of what governments do, rich people already take a huge hit due to the turmoil. In 2008 shareholders of banks like Lehman Brothers and Bear Stearns lost everything. And these high-networth individuals are important to the overall economy. Aside from that it promotes bad incentives, taking on debt is good because you can just take people’s money if it goes wrong, meanwhile saving money is punished, because it will be stolen if things go wrong.

Sources:

https://www.bankrate.com/banking/what-is-a-bank-bailout

https://www.investopedia.com/terms/b/bailin.asp

- How Do You Prepare For These Scenarios? -

In this world of banks and governments playing around with our lives due to the world running on monopoly money, you have to prepare for bad outcomes. Now this doesn’t mean taking all your cash, buying gold, and burying it beneath a tree, that is quite over the top. However, keeping all your money in banks and just trusting that everything will be fine is also quite crazy. Luckily enough there is a more balanced approach, which I often preach to folks and my advice goes as follows.

1. Diversify your banking.

Be sure to hold cash, savings, and assets with multiple different banks, this way you lower your risk, it’s never good to hold all your eggs in one basket after all.

2. Own some physical gold and silver.

Throughout history, precious metals have been used as a form of currency, and this will most likely continue for many years. Meanwhile holding it in a physical form gives you full control over the asset. When it comes to this you wouldn’t need much, a couple hundred dollars is more than enough.

3. Hold some Bitcoin and Ethereum in a private wallet.

We live in a digital world after all, so holding money in these digital currencies that can function without banks or governments is a great option. You are sheltered from almost any serious event, although they do tend to fluctuate in price a lot, and transaction fees can be high which are downsides. When holding these I would advise using a cold wallet though like Trezor.

- Conclusion -

Now I think that at some point we will see another big financial crisis that will force governments to use both bail-ins and bailouts to save the system. And entities like the European Central Bank already have plans to use bail-ins and bailouts during the next crisis. This is worrying if you look at the current divide between the financially sound northern European countries, and debt-ridden southern European countries. So in the end, I think it’s better to be prepared, because the last time we saw a crisis in Europe, the Euro almost fell.

Now if you liked this post be sure to FOLLOW to my page, and if you want even more in-depth posts then become a subscriber! Also if you are interested in my stock portfolio then check out my Etoro account.

Etoro - https://www.etoro.com/people/drwily